Chinese Car Registration Rules in the Philippines

Chinese Car Registration Rules in the Philippines

Whether imported from China or other countries, the vehicle registration process in the Philippines is essentially the same, with no special procedures. However, registering an imported vehicle requires more documents than registering a locally purchased vehicle. Therefore, as long as all required documents are prepared in advance, the registration of your imported vehicle can be completed very quickly in the Philippines.

So, what documents are needed to register an imported vehicle from China or other countries in the Philippines? What are the specific registration requirements? How much does registration cost? How many years is the registration valid? Below, we provide detailed answers to these questions, hoping this information will be helpful.

Definition of Imported Vehicles by the Philippine Land Transportation Office (LTO)

Imported cars are vehicles that have been manufactured and assembled outside thePhilippines and then brought into the country for use.These cars come with documentationfrom their country of origin, such as a commercial invoice and export certificates.Thecharacteristics of imported cars often include different specifications and standards comparedto locally manufactured vehicles,influenced by the regulations and technologies of theexporting country.

A car is categorized as imported when it is shipped from a foreign country to the Philippines forregistration and use.Cars rebuilt with imported parts, however, are not considered ‘imported cars’ in the strictest sense;they are classified based on their assembled origin rather than thesource of individual components.These rebuilt cars must still comply with specific local registration reguirements and standards, including necessary inspections and certifications tohave proper roadworthiness.

What is required to register an imported vehicle in the Philippines?

Registering imported cars in the LTO means officially documenting the vehicle to comply with Philippine laws and regulations.lt involves submitting additional documentation such as theoriginal sales or commercial invoice from the country of origin,an insurance certificate,a Certificate of Stock Reported (CSR), and a PNP-HPG Motor Vehicle Clearance Certificate.Thishelps imported cars meet all legal and safety standards required for use on Philippine roads.

Brand New lmported Completely Built Units (CBUs)

- Original Sales Invoice or Commercial invoice issued by the Country of Origin

Imported Second Hand (Used) Exempted from EO156/877-A

- Original Sales Invoice and/or Commercial lnvoice of Motor Vehicle/ Certificate of Titleissued by the Country of Origin

- Motor Vehicle Inspection Report (MVIR)

- Certificate of Compliance to Emission Standards (CCES)

Imported Second Hand Through the No DollarImportation

- Commercial Invoice of Motor Vehicle or Certificate of Title issued by the Country of Origin

- Certified True Copy of the Authority under the No Dollar lmportation issued by theDepartment of Trade and industry-Bureau of lmport Services (DTl-BIS)Seizure Proceedings and Notice of Award. (lf no authority from BlS)

- Original Affidavit of first and last importation

- Motor Vehicle Inspection Report (MVIR)

- Certificate of Compliance to Emission Standards (CCES)

Imported Acquired Through Donation

- Commercial invoice of Motor Vehicle or Certificate of Title issued by the Country of Origin

- Original Deed of Donation duly signed by donor and the donee

- Original Secretary’s Certificate/Board Resolution when donor is a corporation Motor Vehicle inspection Report (MVlR)

- Certificate of Compliance to Emission Standards (CCES)

- Rebuilt with Local Chassis/Body and with UsedImported Engine

Original Sales lnvoice of Engine, Chassis & Body

- Original Affidavit of Rebuilt executed by the Owner and/or Mechanic with Technical Education and Skills Development Authority

- National Certificate ll (TESDA NC ll) stating among others the date of completion

- Original Certificate of Stock Reported (CSR) for Engine and Chassis

- Motor Vehicle Inspection Report (MVIR)

- Certificate of Compliance to Emission Standards (CCES)

What is the registration process for imported vehicles in the Philippines?

Offline Registration:

Step 1: Gather and prepare all the required documents for registering the type of motor vehicleyou have.

Note: There is a different set of car registration requirements for brand new cars depending on the type whether it is Locally,lmported,Registration of Light Electric Vehicle (LEV) (AO-2006-01),Registration of Low-Speed Vehicle (LSV),Three Wheeled Vehicle,or Tax Exempt.

Step 2: Visit the nearest LTO office that processes new vehicle registrations as not all LTO branches do so.

Note: You may always call the customer hotline of the nearest LTO branch from you to ask if they process new vehicle registration and save yourself the trouble of having to go there onlyto find out that they don’t process car registrations.

Step 3: Once there, go to the appropriate transaction counter.

Step 4: Submit all the documentary requirements you have gathered so the LTO evaluator can assess if the documents are complete and compute the fees based on the information thatthey have regarding your vehicle.

Step 5: Have the MV tested for emissions and submit the Motor Vehicle Inspection Report(MVlR) containing the results.

Step 6: Pay all the necessary fees at the cashier and wait for your OR (official receipt).

Step 7: Once done, wait for your turn at the Releasing Counter to obtain the Certificate of Registration (CR),plates,and stickers.

Online Registration:

Here are the steps you should follow if you want to register your vehicle with the help of LTO Land Transport Management System (LTMS)_portal online:

Step 1: Visit the LTO LTMS Portal online.

Step 2: Log into your account, or if you do not have one yet, register for an LTMS portal online account.

Step 3: Once done, you can then start using the LTMS portal for your specific needs with LTO,like paying off your traffic violation fines as well as your car registration and renewal fees.

Step 4: Take note of the payment reference number (PRN) if you pay the fees online.

Note: You may also schedule an online appointment to visit your preferred LTo branch to streamline the process for your car registration and renewal.

How much does it cost to register an imported vehicle in the Philippines?

The initial registration costs around Php 1,000, excluding additional fees for license plates,stickers,and inspections.For a complete list of fees associated with the registration of imported vehicles in LTO, please see the list below:

License Plate: Php 450.00

Stickers and Tags: Php 50.00 each

Inspection Fees: Php 90.00 to Php 115.00

Registration Fee: Approximately Php 1,000.00 (may vary based on vehicle type and other factors)

Penalty for Late Registration: Php 200.00 per week, up to 50% of the Motor Vehicle User’s Charge (MVUC) for a month delay

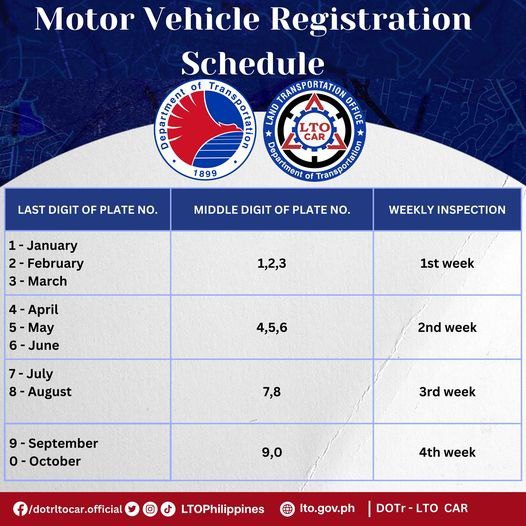

Motor Vehicle Registration Renewal Schedule in the Philippines

The LTO uses the last digit of your vehicle’s plate number to determine which month your registration will expire.Listed below is a detailed explanation of the LTO registration renewal schedule for car owners:

Plate numbers ending in 1 must renew by January.

Plate numbers ending in 2 must renew by February.

Plate numbers ending in 3 must renew by March

Plate numbers ending in 4 must renew by April.

Plate numbers ending in 5 must renew by May.

Plate numbers ending in 6 must renew by June.

Plate numbers ending in 7 must renew by July.

Plate numbers ending in 8 must renew by August.

Plate numbers ending in 9 must renew by September.

Plate numbers ending in 0 must renew by October.

Once you know your registration month,the middle digit of your plate number will determine which week of the month you must have your vehicle inspected for registration.These guidelines ensure that not everyone flock to the LTO office to renew all at the same time,easing the process for both vehicle owners and LTO employees.

Weekly Schedule Based on the Middle Digit

The middle digit of your plate number tells you which week of your designated month you should schedule your renewal.Here’s how it works:

Middle digits 1, 2, and 3: You are scheduled for the 1st week of the month.

Middle digits 4, 5, and 6: You are scheduled for the 2nd week of the month.

Middle digits 7 and 8: You are scheduled for the 3rd week of the month.

Middle digits 9 and 0: You are scheduled for the 4th week of the month.

By following this schedule, you can avoid long queues and ensure your vehicle is renewed on time.Missing your renewal deadline can lead to late fees and even more severe penalties like the suspension of your vehicle’s registration,which can result in inconvenience and legal problems if caught driving without valid registration.

Early Renewal Option

To make the registration process more convenient, the LTO allows early renewal of your vehicle registration.You can renew up to two months before your registration expires. This is especially useful if you expect to be busy during your renewal month or if you want to avoid the stress of rushing at the last minute.Early renewal ensures that your vehicle remains compliant without any disruption in your driving routine.

Frequently Asked Questions (FAQs)

How many years is car registration valid in the Philippines?

In the Philippines, initial registrations of new motor vehicles usually come with a three-year validity.

Can a car be owned by two people in the Philippines?

The Land Transportation Office (LTO) in the Philippines allows for the registration of a vehicle under the names of multiple individuals.

When registering a car under multiple owners, the LTO will specify how the co-owners are related. If the owners are listed with “and,” it means both owners’ signatures are required for any transaction involving the vehicle (e.g., sale, transfer of ownership). If the owners are listed with “or,” it means either owner can act on behalf of the vehicle, such as signing documents for sale or transfer.

It’s important to note that even with co-ownership, the car is still legally owned by the individual(s) whose name(s) appear on the Certificate of Registration (CR) and the Official Receipt (OR).

While the car may have multiple owners, the LTO will typically register the vehicle under only one person’s name. However, the co-ownership arrangement should be clearly documented in the paperwork to protect the rights of all parties involved.

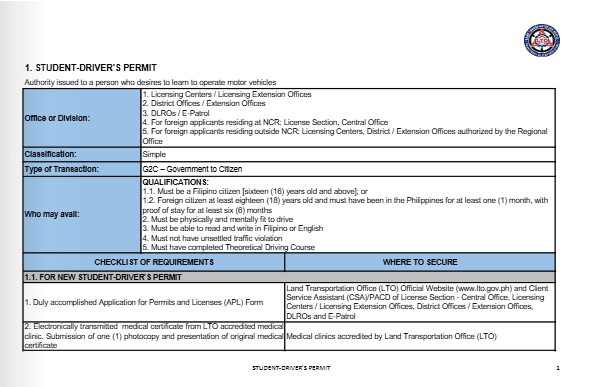

Do I need a separate license to drive a motorcycle in the Philippines?

No. If you intend to drive both a motorcycle and a car, you do not need to apply for a separate license, just add more license codes. In short, applying for a car license and a motorcycle license in the Philippines is more or less the same. All you need to do is take a driving course, apply for a student permit, log your driving hours, and then go to the LTO to get your license….

Can I drive a motorcycle in the Philippines with a car license?

No. You cannot rent or drive a 125cc or even 110cc scooter in the Philippines with a driver’s license unless your license contains the correct DL code. In the Philippines or other Asian countries, your driver’s license must contain the DL code A1 to drive small scooters and large motorcycles.

I have a US car license but not a motorcycle license. Can I drive a 110cc scooter in the Philippines?

No. Your driver’s license must carry a DL Code A or A1, otherwise it is a violation. Your foreign driver’s license is valid for a maximum of 90 days but be sure to bring your international driver’s license as it has a translated version.

Can I drive an automatic car with a manual gearbox?

If the limit is set to “MT”, the license holder can drive both manual and automatic transmission vehicles. However, if the restriction is set to “AT”, only automatic transmission vehicles can be driven.