Documents Required to Import a Chinese Car to the Philippines

Documents Required to Import a Chinese Car to the Philippines

Previously, we have provided guide articles on how to import cars from China, how to avoid scams when purchasing Chinese cars online, and the warranty rules for Chinese cars overseas. Today, we bring you the specific documents required for importing Chinese cars into the Philippines. We believe that after understanding these details thoroughly, you can easily import your desired Chinese car.

I. Pre-shipment Documents (China Export Stage)

Vehicle Compliance Documents

- Compulsory Product Certification (CCC Certificate) : Must be obtained by Chinese manufacturers or importers, proving the vehicle meets safety standards.

- Environmental Information Disclosure Documents : Contain emission test data (must comply with Philippines Euro 4 or above standards) and pollution control technology information.

- Certificate of Conformity (COC) : Requires notarized Chinese-English translation, stating vehicle technical parameters.

- Registration Certificate : Proves the vehicle’s legal origin.

Trade Documents

- Commercial Invoice : Details vehicle price, buyer/seller information, payment terms, etc., requires exporter’s stamp.

- Packing List : Records vehicle packaging details, weight, dimensions; must match invoice information.

- Original Factory Invoice : Proves the vehicle’s ex-factory value.

Philippines Import Permit (Key Document)

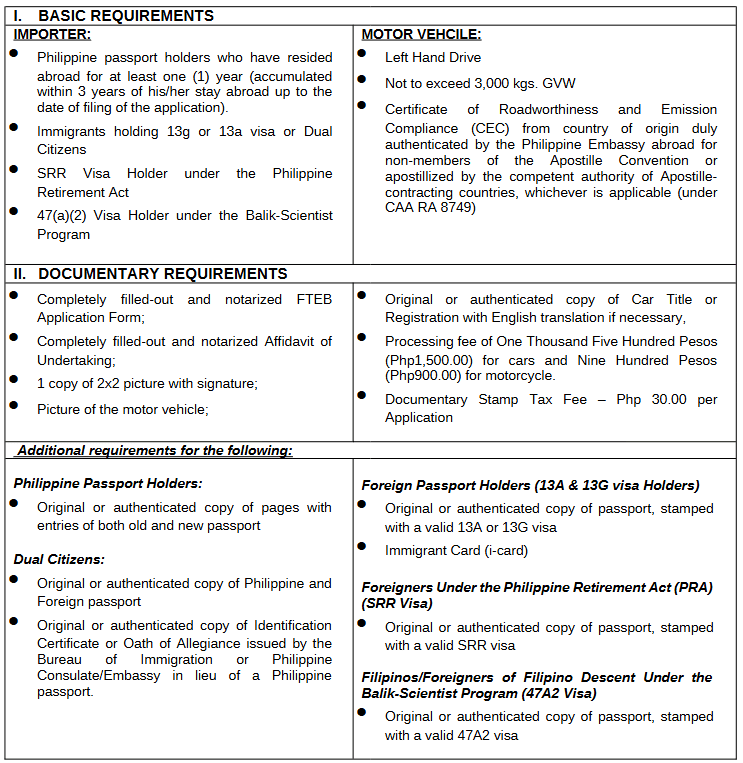

- Import Permit (BOC Import Permit):

New Vehicles: May be exempt in some cases (e.g., electric vehicles), but regular vehicles require prior application.

Used Vehicles: Strictly prohibits import of left-hand drive (LHD) vehicles; only allows right-hand drive (RHD) vehicles meeting age/emission standards; special groups (e.g., overseas Filipino citizens) may be exempt but must provide visa/ID proof (e.g., SRRV visa).

- Import Declaration Form (IDF) : Pre-declares cargo information to Philippine Customs.

II. Transport & Customs Clearance Documents

Transport Documents

- Bill of Lading (B/L) or Air Waybill (AWB) : Issued by the carrier, stating consignee, vehicle information, origin/destination.

- Cargo Insurance Policy : Covers sea/air freight risks; mandatory purchase recommended.

Core Customs Documents

- Import Entry Declaration : Submitted via the Philippines Single Window system (BOC), includes CCC Certificate, VIN, etc.

- Certificate of Origin (CO) : Proves vehicle was manufactured in China; used for tariff calculation.

- Supplemental Declaration on Valuation (SDV) : Declares detailed cargo value; requires notarization.

- Importer Tax Documents:

Tax Identification Number (TIN) : Proof of the importer’s tax registration in the Philippines.

VAT Registration Certificate : Confirms the enterprise’s tax qualification.

Special Documents (Depending on Vehicle Type)

- Vehicle Roadworthiness Compliance Certificate : Requires authentication by the Philippine Embassy in China or Apostille.

- Environmental Documents : Electric vehicles require a Clean Energy Certificate to apply for tax exemption.

III. Taxes & Fees (Clearance Stage)

Taxes calculated based on CIF Value (Cost + Insurance + Freight):

- Customs Duty: Regular cars 20%-30%.

- Value Added Tax (VAT): 12% × (CIF Value + Customs Duty).

- Additional Fees:

Environmental tax, Port fees: Approximately 5%-8%.

Inspection fees (if opening containers to verify mileage/model consistency).

✅ Note: Electric vehicles may enjoy duty exemptions or incentives; confirm policies in advance.

Car import tax Philippines calculator>>>

IV. Vehicle Registration Documents (Philippines Domestic)

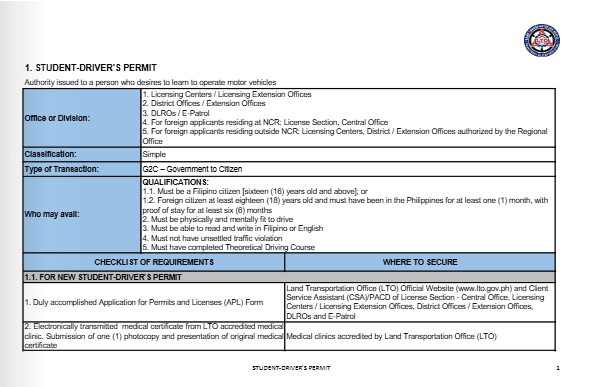

After clearance, submit to the Land Transportation Office (LTO):

- Customs Clearance Proof:

BOC Duty Payment Certificate (Certificate of Payment).

Motor Vehicle Clearance Certificate (MVCC) : Issued by the Police Highway Patrol Group (PNP-HPG), verifies the vehicle is not stolen.

- Technical Documents:

Motor Vehicle Inspection Report (MVIR) : Issued by LTO, confirms vehicle meets safety standards.

Certificate of Emission Compliance (CEC) : Issued by the Department of Environment and Natural Resources (DENR).

- Ownership Documents:

Original Bill of Lading (BOL): Serves as transport proof.

Certificate of Registration (CR) and Original Factory Invoice.

- Insurance Document: Certificate of Cover (COC).

V. Key Considerations

- Left-Hand Drive (LHD) Ban: Only special groups (e.g., SRRV visa holders, dual citizens) can import LHD vehicles; requires additional notarized ID documents.

- Document Consistency: Commercial Invoice, Packing List, and Bill of Lading information must be completely identical; otherwise, customs clearance delays occur.

- Timelines:

Sea freight takes 15-30 days; clearance time is about 7-14 working days (affected by port congestion).

Port free storage period is only 5 days; fees apply after exceeding.

For more detailed step-by-step instructions, you can click on “Rules for Registration of Chinese Vehicles in the Philippines”.