Chinese Largest EV Brand: BYD Leads the Global Market

Chinese Largest EV Brand: BYD Leads the Global Market

The Global Position of Chinese EV Market

China has become a global hub for the manufacturing and consumption of electric vehicles, with its market scale and development speed attracting worldwide attention. According to the latest survey data from TrendForce, global sales of new energy vehicles (NEVs) reached 4.868 million units in the second quarter of 2025, a year-on-year increase of 30%, with Chinese brands contributing a significant share. If hybrid electric vehicles (HEVs) are included, global electric vehicle sales reached 6.456 million units, accounting for 29% of total global car sales.

The Chinese electric vehicle market is not only large in scale but also highly competitive. The transformation of traditional automakers, the emergence of new car manufacturers, and the entry of tech companies have collectively shaped a dynamic and innovative ecosystem. This competitive environment has given rise to many globally competitive brands and products that are redefining the landscape of the global automotive industry.

BYD: A Sales Giant

In terms of sales and data, BYD is undoubtedly the leader in the Chinese and even global electric vehicle markets. In March 2025, BYD sold an astonishing 377,420 new energy vehicles, a year-on-year increase of 24.8%. Even more impressive, in the first quarter of 2025, BYD’s cumulative vehicle sales exceeded one million units, reaching 1,000,804 units, a year-on-year increase of 59.8%.

Globally, BYD’s leading position is equally solid. In the second quarter of 2025, BYD maintained its position as the largest global pure electric vehicle (BEV) brand with an 18.3% market share, achieving a sales growth rate of 43% year-on-year. In comparison, although Tesla remained the second-largest in market share, its sales during the same period decreased by approximately 14% year-on-year.

The following is a comparison table of sales figures for major Chinese electric vehicle brands in March 2025 (based on available data):

| Brand | March 2025 Sales (Units) | Year-on-Year Growth | Q1 2025 / H1 2025 Sales |

| BYD | 377,420 | 24.8% | 1,000,804 units (Q1) |

| Zeekr Technology | 40,715 | 24.6% | 114,011 units (Q1) |

| Leapmotor | 37,095 | 154% | 221,664 units (H1) |

| Li Auto | 36,674 | 26.5% | 92,864 units (Q1) |

| XPeng Motors | 33,205 | 268% | 94,008 units (Q1) |

| Xiaomi Auto | 29,000+ | – | – |

Table: Sales Data of Major Chinese Electric Vehicle Brands

BYD’s success stems from several key factors:

- Extensive product portfolio: The Dynasty series (Tang, Song, Han, Qin, etc.) and the Ocean series cover multiple market segments from family sedans to SUVs.

- Diversified technology approach: Offers both pure electric (BEV) and plug-in hybrid (PHEV) models.

- Vertical integration capabilities: Masters core component technologies such as batteries, motors, and electronic controls.

- Internationalization strategy: In March 2025, BYD’s overseas sales exceeded 70,000 units for the first time.

Other Major Players

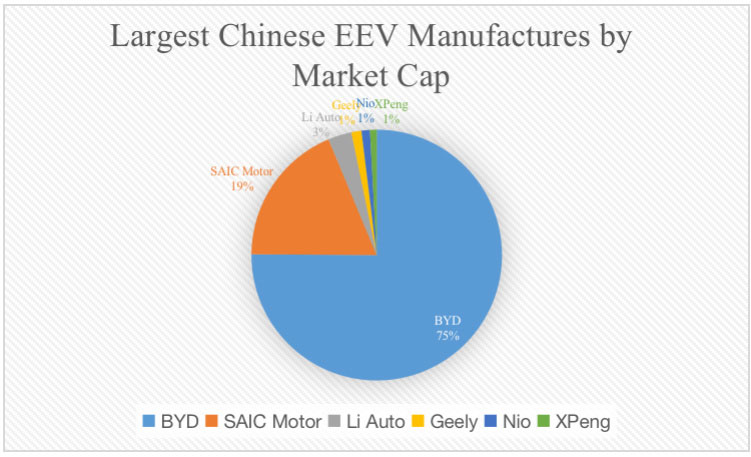

Although BYD dominates the market, there are several other important players in the Chinese electric vehicle field, each with its unique market positioning and competitive advantages:

- Geely Auto: As a representative of traditional automakers’ transformation, Geely maintains the third place in the global pure electric vehicle market with a 6.4% market share. Its Zeekr brand is positioned in the high-end market, with sales reaching 15,422 units in March.

- Leapmotor: One of the fastest-growing new forces brands. In the first half of 2025, it delivered 221,664 new vehicles, a year-on-year increase of 155.7%, ranking first in sales among Chinese new forces brands. By August 2025, Leapmotor’s cumulative deliveries had exceeded 900,000 units. It is worth mentioning that Leapmotor has become the second among China’s new forces to achieve semi-annual profitability.

- Xiaomi Auto: As a new entrant to the industry, Xiaomi has shown astonishing explosive power. Its high-end model, the SU7 Ultra, performed particularly well in the market above 500,000 yuan, with sales reaching 12,618 units from January to July 2025, surpassing competitors like the Li Auto MEGA and NIO ET9. In the global market, Xiaomi has already entered the top ten global pure electric vehicle brands with a 2.5% market share.

- Li Auto: Focuses on extended-range electric vehicles and precisely targets the family vehicle market. In March 2025, it delivered 36,674 new vehicles, a year-on-year increase of 26.5%. The Li Auto MEGA also performed well in the high-end market, with sales of 9,144 units in the market above 500,000 yuan from January to July.

- XPeng Motors: Core selling point is its intelligent driving technology. In March 2025, it delivered 33,205 new vehicles, a year-on-year increase of 268%, marking the fifth consecutive month with deliveries exceeding 30,000 units.

Global Influence and Future Prospects

The global influence of Chinese electric vehicle brands is rapidly increasing. Not only has BYD’s overseas sales grown significantly, but new forces like Leapmotor are also accelerating their international expansion. As of the end of June 2025, Leapmotor International had established about 600 sales and after-sales service outlets in approximately 30 international markets.

The Chinese government’s support policies for the new energy vehicle industry, such as trade-in subsidies and purchase tax exemptions, although expected to end by the end of 2025, have provided important initial momentum for the industry.

In the coming years, the Chinese electric vehicle market is expected to continue growing, but the growth rate may slow down. TrendForce estimates that global new energy vehicle sales will reach 19.7 million units in 2025, a year-on-year increase of 21%, and the growth rate may slow to 14% in 2026.

Conclusion

In summary, BYD is undoubtedly China’s largest electric vehicle brand, demonstrating significant leadership both domestically and globally. Its comprehensive product line, leading technology, and strong production capacity make it far ahead in terms of sales and market share.

However, the charm of the Chinese electric vehicle market lies not only in BYD’s absolute leadership but also in its diverse and dynamic competitive environment. From traditional automakers transforming like Geely and GAC Aion, to new forces such as Leapmotor, Li Auto, XPeng, and NIO, and even tech companies crossing over like Xiaomi, together they form the most innovative and competitive electric vehicle ecosystem in the world.

For global consumers, Chinese electric vehicle brands are no longer followers but have become leaders in many aspects of the global industry, especially in battery technology, intelligent driving, and user experience. As these brands accelerate their international expansion, the global electric vehicle market landscape will continue to be reshaped, and the influence of Chinese brands will only grow.