Geely Auto:Top Pick for International Importers in 2025

Geely International EX5 launched in Australia. It debuted at Sydney’s Luna Park (March 2025). Within 20 days, it reached top 9. It ranked among Australia’s best-selling EVs. Three months later, it beat BYD. It became China’s top EV brand there. Thus, it changed “slow traction” perceptions.

This Australian success was no accident.

In June, Geely partnered with Renault. They formed a Brazil-focused joint venture. Brazil is Latin America’s largest market. Next, in July, Geely entered Italy. It teamed with Aljomaih Automotive. Meanwhile, Galaxy E5 assembly prep accelerated. Work surged at Belarus’ BelGee factory.

Global Expansion: Emerging Markets Strategy

Mexico City announced a bold target. By 2040, 50% of vehicles will be green. Almost concurrently, Geely made a move. In February 2024, it signed an agreement. It partnered with its premium EV brand Zeekr. The deal was disclosed via HKEX.

Geely will buy Zeekr vehicles and parts. These are solely for Mexican resale. Purchase figures reveal strong ambition. Amounts will hit RMB 674 million (2024). Then RMB 1.564 billion (2025). Finally RMB 3.129 billion (2026).

Southeast Asia is vital for Geely. Vietnamese firm Tasco signed a deal. They’ll build a plant in Thai Binh (Sept 2024). Total investment is $168 million. Geely owns a 36% stake. Annual capacity starts at 75,000 units. It will assemble Lynk & Co and Geely models. Construction begins early 2025. First deliveries start early 2026.

Belarus’ BelGee factory prepares too. It will assemble Galaxy E5 late 2025. This EV, named EX5 locally, targets Eastern Europe. The Galaxy E8 will join it. This plant has built Geely cars since 2013. Notably, 80% output went to Russia. This shows supply chain flexibility.

Brazil required a different approach. Geely chose a Renault joint venture (June 2025). It focuses on production and sales. Covered are Renault and Geely vehicles. Therefore, Geely uses Renault’s local expertise. It avoids heavy greenfield investments.

Technology & Products: Winning Global Markets

A Chinese EV starred in Melbourne. Geely International EX5 drew huge crowds. Its smart cockpit won Australians over. Long range and great driving helped too. Behind this lies Geely’s global manufacturing.

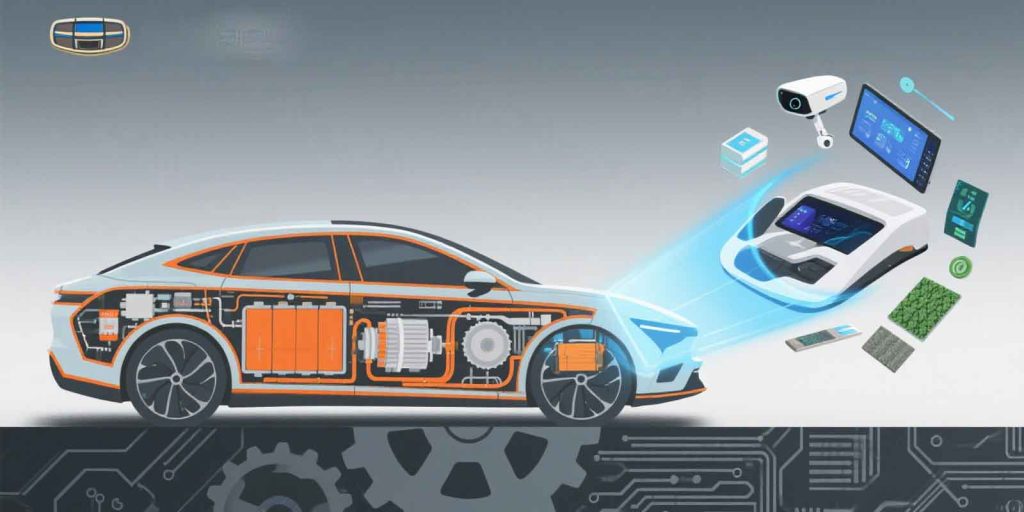

Shield Battery Safety Tech is key. Launched in 2023, it passed tough tests. These exceeded industry standards significantly. Tests covered cells, packs, and whole vehicles.

Geely offers varied powertrain options. Flagship sedan Galaxy E8 has choices. These include single-motor and dual-motor AWD. The dual-motor version delivers 475kW power. It sprints 0-100 km/h in 3.49 seconds. Belarus’ Prime Minister test-drove it. He called it “practically a sports car”.

Geely leads in smart driving too. It revealed “Whole Vehicle AI” in 2025. This pioneering tech boosts its profile. Now, Geely operates in 80+ countries. It runs 12 factories globally. Additionally, it has 5 R&D centers. Its workforce exceeds 50,000 employees.

Localization: Deep Regional Integration

Milan hosts a Geely design center. Active since 2023, it shapes European EVs. It collaborates with top Italian designers. Together, they tailor solutions locally.

Geely entered Italy officially in July 2025. It signed with Aljomaih Automotive. Their plan includes launching two models. Geely International EX5 arrives first. A plug-in hybrid SUV follows. Both debut in Q4 2025.

Aljomaih builds ~100 service outlets. These provide full Italian customer support.

Malaysia saw a tech transfer model. Proton launched Malaysia’s first EV (Dec 2024). The e.Mas7 SUV uses Geely’s Galaxy E5. Geely holds 49% of Proton. Thus, it navigates Southeast Asia smoothly.

Strong logistics aid global growth. In March 2022, 160 Geely cars shipped out. They used rail-sea transport from Xiangtan. Route: Zhuzhou → Guangzhou Port → Malaysia. This cut logistics costs sharply. Xiangtan Geely planned 40,000 exports that year.

Overcoming Trade Barriers

EU raised tariffs in October 2024. It added duties despite China’s objections. Existing 10% tariff got extra charges. Geely faced an 18.8% rate. CEO Gui Shengyue remained confident.

“Our tech edge lets us absorb tariffs,” he told SCMP. “True cost reduction needs tech progress.”

Unlike peers building overseas plants, Geely stays flexible. Gui stressed a “light-asset strategy”. It partners with local firms abroad. This minimizes fixed assets on books. It boosts EU and global sales.

Russia’s market tested this approach. Higher taxes and import rules hurt sales. January 2025 sales fell 30.9% year-on-year. It had prepared a response. It launched the Knewstar “mask brand”. The Knewstar 001 is based on Xingyue S. This allows strategic adjustments.

2025 Outlook: Global Opportunities

Gui Shengyue predicts a major shift. “Overseas sales will pass domestic by 2025,” he stated. Foreign interest in smart cars drives this.

Strong data backs his forecast. Jan-Nov 2024 exports jumped 56%. They reached 379,000 units. Exports were 19.3% of total sales.

Geely’s EV business breaks even. This is rare among Chinese EV makers. Profitability is now vital. Gui noted normalized capital markets demand it.

Importers gain multiple advantages. Geely’s network spans key regions:

Southeast Asia (Vietnam, Malaysia)

Eastern Europe (Belarus)

Latin America (Brazil, Mexico)

Western Europe (Italy)

Flexible cooperation models exist:

Technology transfers

Joint venture factories

Brand distribution deals

Complete vehicle exports

Italian designers refine Galaxy E8 interiors. Vietnam’s new factory foundation sets. Australian dealers order more EX5 units.

Choosing Geely means more than cars. Importers get a mature global system:

Brazil JV avoids trade walls

Malaysia production slashes logistics

European design ensures local appeal

Geely’s overseas sales will soon lead. Early partners already ride the new auto trade wave.

Feel Free To Contact Ahcarsale Anytime

More Article

More Cars

Latest Articles