Top Chinese Automotive Exports in 2025

Which Chinese Automotive Exports the most in the first half of 2025? BYD? Chery? Or Geely? What are their specific export sales figures for the first half of 2025, and which are their popular models? Enthusiasts following the Chinese automotive industry are surely eager to know. Therefore, Ahcarsale brings you a detailed breakdown of the top five Chinese automotive brands by export volume in 2025, offering a clear perspective on the performance of Chinese automobiles in the global market during the first half of 2025.

I. Overview of Chinese Automotive Exports in the First Half of 2025

Total Volume and Growth Rate

Cumulative exports from January to May 2025 reached 2.49 million units, a year-on-year increase of 7.9%. New energy vehicles (NEVs) accounted for 36.6% of exports (up 5% YoY).

Top Three Export Destinations/Regions: Russia (25% of total volume), Mexico (monthly average: 52,000 units), UAE (monthly average: 50,000 units).

Structural Changes

- NEV Surge: Plug-in hybrid (PHEV) exports surged 187.9% YoY (e.g., BYD DM-i technology), while pure electric vehicle (EV) growth slowed to 34.6% due to EU tariffs.

- Regional Shift: EU market share declined (MG exports to Europe fell 27.6% MoM), while Southeast Asia (Philippines: +16,181 units) and Central Asia (Kazakhstan: +11,052 units) emerged as new growth engines.

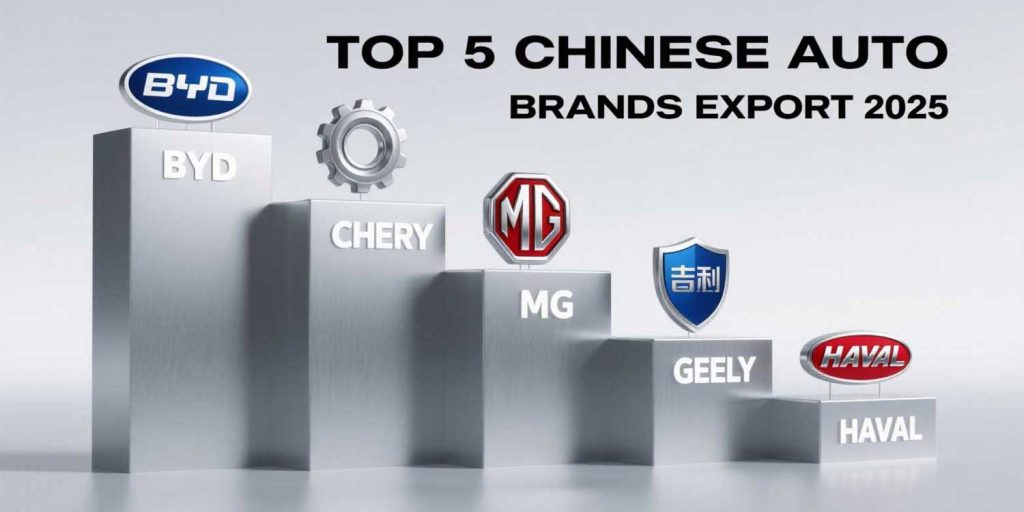

II. TOP 5 Chinese Automotive Exports Volume & Core Data

| Brand | 2025 H1 Export Volume | YoY Change | Key Markets |

| BYD | ≈450,000 units | +117.27%* | Western Europe, Australia, Middle East, SE Asia |

| Chery | ≈400,000 units | +18.8%* | Russia (40% share), Middle East, Latin America |

| MG | ≈350,000 units | -41.54%* | UK, Mexico, Australia/New Zealand |

| Geely | ≈250,000 units | -15.42%* | Russia, Middle East, Belgium |

| Haval | ≈150,000 units | -51.44%* | Russia, Middle East, Australia |

| *Note: Data marked * are Q1 or monthly YoY figures; total volume extrapolated based on Jan-May data and growth rates.* | |||

III. TOP 5 Chinese Automotive Exports Models

BYD: Global NEV Leader

Popular Models:

- Song PLUS DM-i (30% of exports): Price: ¥220,000-260,000. Pure EV range: 120km; fuel consumption in hybrid mode: 4.4L/100km; supports V2L external discharge.

- Seagull EV (SE Asia hit): Price: ≈¥80,000. Range: 405km; 30-min fast charge (80% capacity); standard 6 airbags.

Core Advantages:

- Full NEV lineup (EV + PHEV); DM-i hybrid tech reduces powertrain shift lag.

- Localized production in Thailand/Brazil to bypass tariffs.

Chery: Fuel Vehicle Dominance in Emerging Markets

Popular Models:

- Tiggo 7 PRO (No.1 market share in Russia): Price: ≈¥150,000. 1.6T engine + 7DCT; L2+ ADAS; 80% high-strength steel body.

- Tiggo 8 PHEV (Key model in Middle East): Price: ¥200,000-240,000. Pure EV range: 100km; total range: 1300km; supports 3.3kW external discharge.

Core Advantages:

- High-value fuel SUVs adapted to developing-market road conditions.

- Localized production in Russia reduces political risks.

MG: European Heritage + Latin America Breakthrough

Popular Models:

- MG4 EV (UK’s best-selling Chinese car): Price: ≈¥220,000. Rear-wheel drive; range: 450km; 10.25-inch central screen.

- MG ZS (Sales champion in Mexico): Price: ≈¥120,000. 1.5L naturally aspirated engine; standard reversing camera.

Core Challenge:

- EU tariffs rising to 38.1% forcing production shift to Mexico.

Geely: Technology Transfer + NEV Transition

Popular Models:

- Galaxy L7 (Main model via Belgium hub): Price: ¥180,000-220,000. Leishen hybrid system; pure EV range: 115km; 0-100km/h: 6.9s.

Strategic Layout:

- Entering Europe via Volvo channels; Russian sales up 50% YoY.

Haval: Fuel SUV Base + NEV Exploration

Popular Models:

- Haval H6 HEV (Hot seller in Australia): Price: ≈¥160,000. Lemon Hybrid DHT; fuel consumption: 5.2L/100km.

Transition Direction:

- PHEV models growing >20% in Philippines.

IV. Competitive Landscape & Future Challenges

- Leadership Consolidation: BYD and Chery lock top two spots via full supply chains and tech barriers; MG drops to third due to EU sanctions.

- Geopolitical Risks:

- Russian market volatility (2025 imports down YoY) impacts Chery/Haval.

- EU carbon tariffs + US Inflation Reduction Act restrict NEV expansion.

- Tech Race:

- PHEV models become new export engine (187.9% YoY growth).

- Smart cockpits (e.g., HarmonyOS) key to premiumization.

2025 Full-Year Outlook: BYD may exceed 1 million exports; second-tier brands (e.g., Jetour, GAC Trumpchi) target African markets via Belt and Road.

Feel Free To Contact Ahcarsale Anytime

More Article

More Cars

Latest Articles