Why Are Chinese Cars So Cheap?

- I. Scale Economy: The Cost Slasher of Mega-Production

- II. Supply Chain Autonomy: The Cost Magic of 300km Industrial Radius

- III. Policy Engine: How Government Fuels Automakers?

- IV. Emerging Market Customization: Victory of Feature Trimming Art

- V. Quality Myth: Safety Data Shatters Bias

- Conclusion: Who Should Buy Chinese Cars?

- FAQ (Semantic Match to High-Frequency Queries)

- Feel Free To Contact Ahcarsale Anytime

Introduction: The Global Shockwave of Price Depression

When European consumers discover Chinese SUVs are 40% cheaper than comparable Japanese models, the “low price, low quality” stereotype is being shattered by a technological revolution. China’s 2025 auto exports surpass 1.93 million units (52% NEVs), with price advantages rooted in a comprehensive industrial chain restructuring—from BYD’s self-built ro-ro vessels reducing costs by 10%, to CATL slashing battery costs by 70% over three years. An efficiency revolution driven by “Economies of Scale + Policy Dividends + Precision Targeting” isdisrupting the century-old auto industry.

I. Scale Economy: The Cost Slasher of Mega-Production

Production Supremacy: BYD’s single-factory annual capacity reaches 1.2 million units, with per-model mold amortization costs at 1/3 of Volkswagen’s. Its 2025 H1 NEV bus exports hit 2,082 units (+45% YoY), scaling reduces R&D cost per vehicle to below ¥800.

Battery Cost Revolution: CATL’s Kirin battery mass production cuts pack cost to ¥400/kWh (vs. ¥1,200 in 2021), reducing share of total vehicle cost from 40% to 28%. 1 in 3 global EVs uses Chinese batteries.

Logistics Dominance: SAIC’s “Anji Angsheng” ro-ro vessel carries 9,500 vehicles per trip; BYD’s self-owned fleet shortens Europe shipping cycles from 40 to 28 days, cutting per-vehicle freight costs by 10%.

Chinese Automakers’ Production Cost Comparison Table

| Indicator | BYD | Toyota | Cost Advantage Source |

| R&D Cost per Vehicle | ¥800 | ¥2,300 | Sales Volume Amortization |

| Battery Procurement Price | ¥400/kWh | ¥680/kWh | Vertical Supply Chain |

| Europe Logistics Cycle | 28 days | 45 days | Self-Owned Ro-Ro Fleet |

II. Supply Chain Autonomy: The Cost Magic of 300km Industrial Radius

Localized Components: 72% of BYD suppliers are within Guangdong Province. Assembly cost for the motor+controller+battery “Golden Triangle” is 34% lower than EU/US. Chip localization rate rose from 25% (2020) to 80%, avoiding overseas supply cuts.

Agile Development: New vehicle R&D cycles compressed from 40 to 12 months (e.g., Deepal S05 RHD version produced in Thailand in 11 months), 30% faster than European OEMs.

Tariff Evasion Strategy: Factories in Hungary/Thailand achieve 45% localization, offsetting EU carbon tariffs (e.g., BYD Han in Germany rose only 5% vs. tariff impact).

III. Policy Engine: How Government Fuels Automakers?

Direct Subsidies: NEV purchase tax exemption + trade-in subsidies slash terminal prices by 15% (e.g., BYD Qin PLUS DM-i entry model reduced to ¥79,800).

Expedited Export Tax Rebates: Shanghai port’s “pre-declaration + green channel” cuts clearance time by 40%, rebates processed in 3 workdays.

Technical Standard Export: RCEP agreement spreads China’s “Three Electric” standards across ASEAN, charging compatibility reduces ops costs by 18%.

IV. Emerging Market Customization: Victory of Feature Trimming Art

Precision Feature Cuts:

Haval H6 MENA Edition: Cancel seat heating, add desert cooling system + sand filters

Wuling Bingo SEA Edition: Demist mirrors as optional, boost AC cooling power by 30%

Modular Platform Warfare: Chery Kunpeng platform cuts R&D costs 50%, enables rapid LHD/RHD variants. Brazil highland version adds anti-sulfation battery tray.

Repair-Friendly Design: Great Wall Poer pickup uses exposed wiring, enabling African users to self-replace parts. Maintenance cost 60% lower than Toyota Hilux.

V. Quality Myth: Safety Data Shatters Bias

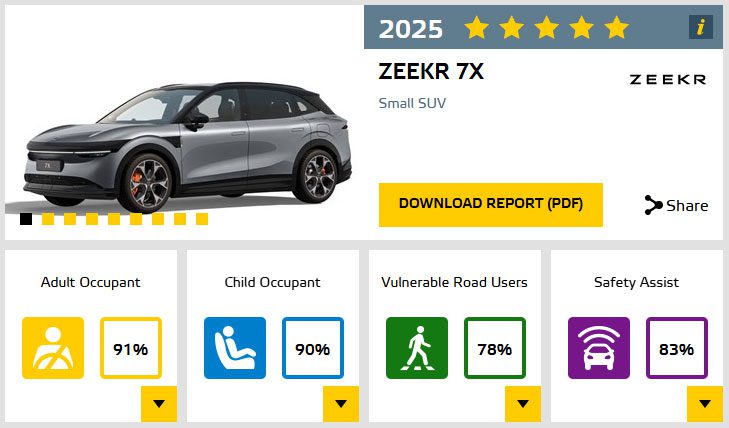

Crash Safety Leap: Geely‘s Zeekr 7X scores Euro NCAP’s highest child protection (90/100). Polestar 4 adult protection (92/100) beats BMW iX.

Durability Proof: South African taxi driver reports Chery Tiggo 8 runs 320,000 km with only tire changes. CATL Kirin battery cycle life hits 4,000 times (3x 2019 tech).

Quality Countermeasures: Responding to J.D. Power’s report on rising NEV failure rates (226 cases/100 vehicles), leading brands launch “double warranties”—BYD’s lifetime “Three Electric” guarantee, NIO’s 10-minute battery swap response.

Conclusion: Who Should Buy Chinese Cars?

Practical Families: L2 autonomous driving + 200km EV range under ¥100k (BYD Qin PLUS DM-i)

Infrastructure Firms: 40% lower procurement cost for work pickups (Great Wall Poer vs. Toyota Hilux)

Ride-hailing Drivers: AION Y 430km version: ¥0.1/km electricity cost

Luxury Collectors: Brand premium > practical value

Call to Action:

[Click to View High-Value Chinese Cars Export Models List]

FAQ (Semantic Match to High-Frequency Queries)

Q1: Are Chinese cars safe? Can they pass EU crash tests?

A: 2025 Euro NCAP TOP10 includes 4 Chinese models. Zeekr 7X child protection 90/100, Lynk & Co 02 safety assist 89/100 ranks global No.1. BYD Seal side impact rigidity hits 55,000 Nm/deg, surpassing Audi A8.

Q2: If imported Chinese cars break down overseas, is repair impossible?

A: Chinese automakers built parts centers in 31 countries (Africa 3-day delivery/Europe 24h response). BYD established training centers in the Netherlands to cultivate local technicians.

You can get detailed information about overseas warranty for Chinese cars from that article:Warranty for Chinese Cars Overseas: What’s Covered?

Q3: What residual value remains after 3 years of owning a Chinese car?

A: BYD launched “value retention buyback”—Han EV 3-year residual rate hits 68% (close to Camry Hybrid). Haval H6 second-hand price in Southeast Asia surpasses Honda CR-V.

Feel Free To Contact Ahcarsale Anytime

More Article

More Cars

Latest Articles